There’s more to successful auditing than financial audits meant to appease stakeholders on the accuracy and completeness of financial statements. All types of businesses—from the government- and private-run to hospitals, banks, manufacturers, and universities—need an accurate, detailed picture of how they’re doing and where they can improve to achieve more substantial financial growth. This is where the importance of operational audits, and effectively communicating recommendations to relevant stakeholders, comes into play.

Organizations may have a general idea of how they’re doing by analyzing internal data through graphs and reports. But, sometimes, being so close to the source doesn’t allow these companies to see the whole picture with complete objectivity—therefore, missing out on alternate solutions when problems arise. So, to get more than just a snapshot, companies are turning to operational audits to analyze current operations and receive an entire album of fresh ideas for improving their businesses.

Read on to understand the basics of operational audits—what they are, the different types of audits, objectives, shared benefits and challenges, and how you can increase your organization’s efficiency and, therefore, your bottom line by incorporating operational auditing into your business strategy plan.

- What is an Operational Audit?

- What are the Objectives of an Operational Audit?

- What are the Benefits of Operational Auditing?

- Category #1: The Organization Itself

- Category #2: The Organization’s Employees

- Category #3: The Consumer

- Category #4: The Environment

- What Challenges Should I Expect When Performing Operational Audits?

- Different Types of Operational Audits

- Audit Type #1: Information Technology (IT) Audits

- Audit Type #2: Financial Audits

- Audit Type #3: Marketing Audits

- Audit Type #4: Departmental Audits

- Audit Type 5: Compliance Audits

- Audit Type #6: Investigative Audits

- Audit Type #7: Follow-Up Audits

- 7 Steps Most Operational Auditors Take

- Step #1: A Meeting Between the Auditor & Management Team

- Step #2: Verify Concerns & Risks With Key Players

- Step #3: Define Goals for the Audit

- Step #4: Design Control Tests

- Step #5: Execute and Document Everything

- Step #6: Draft the Completed Audit

- Step #7: Do a Thorough Review

- Ready to Invest in an Auditing Tool that Literally Pays for Itself?

What is an Operational Audit?

An operational audit is an in-depth, forward-looking process that auditors use when evaluating an organization’s internal processes and operational activities. The long-term outlook of using these audits is to improve company performance according to measurable criteria like speed, quality, efficiency, flexibility, customer value, environment, and operational costs. In addition, the results from this type of audit can help diagnose areas needing further attention and protect company assets by catching—therefore preventing—future risks.

The Institute of Internal Auditors’ defines operational auditing as systematic processes for evaluating an organization’s efficiency, effectiveness, and economy of operations under its management’s control and reporting the evaluation results and recommendations for improvement to appropriate employees.

Operational auditing goes beyond financial reporting. The primary data sources for operational auditing are the policies and achievements related to an organization’s objectives. Because they’re a deep dive into every avenue of company management, the time it takes to complete and finalize an operational audit varies from just a few weeks to several months. The length of time also depends on:

- The size, scope, and complexity of the organization

- If the audit is for the entire operation or a specific unit of business

The difference between a financial statement audit and an operational audit is during the financial audit, the auditor is typically concerned with just the accounting practices and numbers. In contrast, an operational audit evaluates the efficiency and effectiveness of a company’s operations. It examines how the company’s processes and procedures work to identify areas for improvement to help increase productivity, reduce costs, and improve overall performance. Also, operational auditing is generally done by an internal auditor, unlike financial audits, which external auditors often complete.

What are the Objectives of an Operational Audit?

Before we jump right into the objectives of an operational audit, let’s discuss the goals for most businesses in general:

- Profitability

- Productivity

- Innovation

- Market expansion

- Efficient managerial and employee performance

- Promote the well-being of society and the environment

If your business objectives align with most companies, operational auditing can help you achieve these objectives by evaluating:

- Company objectives, plans, and policies

- The structure of your organization

- The measures and controls you currently have in place

- Employee performance includes everything from your workforce, workflow, and workload to productivity, profitability, job performance and costs

- Social responsibilities such as consumer benefits, employment opportunities, and environmental risks

While business objectives vary according to the type of business and its KPIs, operational audits also vary depending on whether the audit addresses specific concerns such as customer satisfaction, human resources, manufacturing, or government compliance issues.

Part of your objective should include maintaining quality in your auditing process. It’s best practice to follow the standards outlined by ISO 19011.

What are the Benefits of Operational Auditing?

Organizational audits are a clear window into how an organization operates. They offer new perspectives on the good and not-so-good aspects of a company’s processes and practices. As a result, management learns of new issues they may otherwise not have been aware of and uses the results of the audits to motivate team members and encourage new or existing goals.

It’s all about making improvements to increase profit, stay legally compliant, and ensure operational efficiency.

There are four categories of people who benefit from operational audits. The:

- Organization itself

- Organization’s employees

- Organization’s consumers

- Environment

Category #1: The Organization Itself

There are a few significant organizational benefits to performing a thorough audit:

Recognize the risk. Various risks are associated with organizations, ranging from human error, product failure, fraud, loss of key employees, business interruption, loss of suppliers, IT system failures, litigation, and health and safety issues.

Risk improvement opportunities. Once you recognize the risks, auditors can determine how to mitigate them by making improvements in their specific categories—reputational risk, financial risk, operational risk, and environmental risk.

Affect positive change. The comprehension of how policies, procedures and processes can produce efficiency and effectiveness.

Internal controls review. Realize the impact of successes and failures within each specialized operation area.

Category #2: The Organization’s Employees

Operational audits encourage employees to continuously improve their performance by applying the knowledge and skills learned from the results of the audits. This is widely beneficial for boosting collaboration and company morale.

Category #3: The Consumer

Operational audits help deliver higher-quality, more cost-efficient products or services to the consumer, often leading to repeat business.

Category #4: The Environment

The entire world benefits when organizations create sustainable products and services wherever possible, allowing a more sustainable future for the environment.

What Challenges Should I Expect When Performing Operational Audits?

Performing operational audits can give organizations explicit opinions. These opinions can generate faster production and sales turnaround time, improved control systems, a better understanding of cost allocations, areas of delay, and a more comprehensive, streamlined workflow.

But, like almost everything in life, there are some challenges when performing operational auditing:

- They cost money

- They can cause employees involved to lose valuable time from general duties

- The more complex the operations, the longer the audit takes

- They can cause confusion and frustration among staff

- They often require retraining

- The need for changing staff

Different Types of Operational Audits

Besides general operational audits, some specific functions and operations of a business require their own reviews.

Audit Type #1: Information Technology (IT) Audits

IT audits are a probe into the technical operations of a business. They investigate the current network and infrastructure, review the procedures and status of security, and analyze project management and data center operations.

Audit Type #2: Financial Audits

Financial audits center around a business’s financial controls and procedures concerning reporting externally to governing bodies and internally to upper management. Internal auditors complete budget and financial reviews, while external auditors handle financial statement audits.

Audit Type #3: Marketing Audits

Marketing audits are a broad but accurate investigation into a business’s advertising. The audit examines external results while thoroughly challenging internal strategies, processes, systems, capabilities, and marketing goals.

Audit Type #4: Departmental Audits

Different divisions of a company or business periodically run investigations to ensure employees are using designated resources and protecting assets, existing controls are adequate, and laws are being complied with.

Audit Type 5: Compliance Audits

Compliance audits analyze the degree of compliance with internal controls and policies and external regulatory requirements.

Audit Type #6: Investigative Audits

Investigative audits happen when there’s a suspected risk of a security breach or if a breach actually occurs. A thorough investigation uncovers direct causes, persons involved, and future preventative measures.

Audit Type #7: Follow-Up Audits

An auditor schedules a follow-up when an audit uncovers something that requires corrective action. Depending on the severity of the issue, follow-up audits can be scheduled anywhere from 30 days to six months later—this is when the auditor evaluates and signs off on corrective measures.

7 Steps Most Operational Auditors Take

Most auditors build operational audits using seven critical steps to ensure an accurate, efficient, and quality audit.

Step #1: A Meeting Between the Auditor & Management Team

The auditor holds a general meeting with the management team to outline the auditing process and gathers relevant information to determine risks and concerns.

Step #2: Verify Concerns & Risks With Key Players

Key managers directly involved with the audit verify and add, if needed, the different components and associated concerns and risks.

Step #3: Define Goals for the Audit

At this stage, the auditor develops distinct goals for the audit, like setting targets above industry standards or speeding up set production times.

Step #4: Design Control Tests

The auditor designs testing procedures to measure the desired effect of each key control and shares those processes with management.

Step #5: Execute and Document Everything

The auditor executes the tests and carefully documents the results and the recommendations for improvement.

Step #6: Draft the Completed Audit

The auditor drafts a completed audit with specific proposals and execution options.

Step #7: Do a Thorough Review

The auditor collaborates with the management team to thoroughly review the results and ensure a clear understanding of all issues that need addressing.

Ready to Invest in an Auditing Tool that Literally Pays for Itself?

As you can see, operational auditing is pretty exhausting work. Especially if you’re thinking about doing things manually.

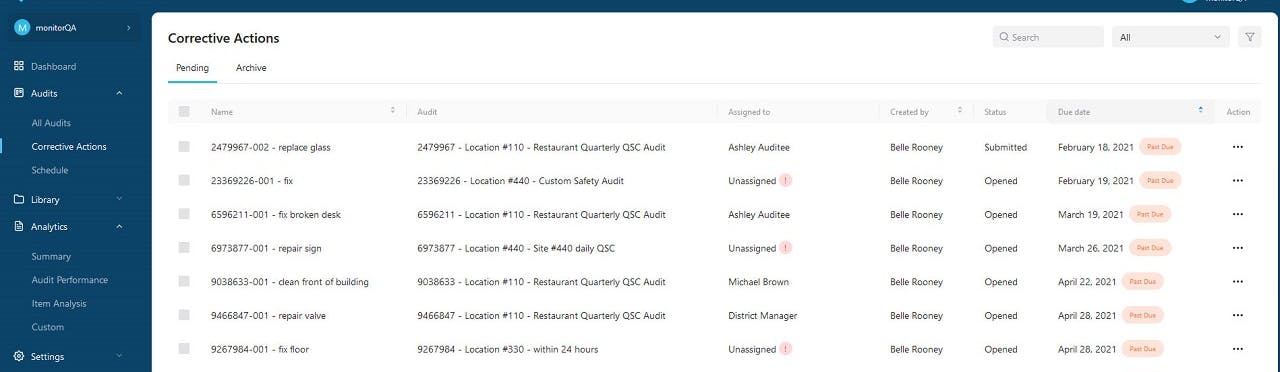

monitorQA is mobile inspection software that makes operational auditing easy. Forget manual tracking and paperwork. monitorQA streamlines compliance audits while improving your health, safety, and quality standards.

Use the smart audit form builder to quickly get started on your audits with pre-designed templates based on your industry, and customize, skip, and autofill checklists using conditional logic. Designed for on-the-go mobile users, monitorQA’s inspection software is your go-to partner for flexible, intuitive, and completely customizable operational audits.

Ready to learn what monitorQA can do for your business?